Adapted from a TweetStorm.

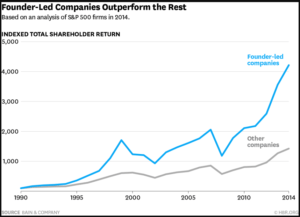

An “index of Fortune 500 companies in which the founder is still deeply involved performed 3.1 times better than the rest over the past 15 years” from Bain & Company

Do founder CEOs outperform because they have:

– Owner’s mindset

– Unique, spiky feature, or capability that gives a business special purpose

– Front line obsession

Do founder CEOs outperform because they have:

Have a track record of success?

Have significant “skin in the game”?

Have incentives that are closely aligned with shareholders?

Professional CEOs are effective at maximizing, but not finding, product cycles. Conversely, founding CEOs are excellent at finding, but not maximizing, product cycles.

Do founder CEOs outperform because they have:

Comprehensive knowledge

Moral authority (to make changes or do non-intuitive things)

Total commitment to the long-term

Here’s a good quote on why founder CEO’s outperform: “The social capital and moral authority that comes from being the founder and having built many of the company’s key products means that on balance people trust you more and give you the benefit of the doubt more when you make tough calls “ – Zuckerberg

On the level of the proposition that founders outperform as CEOs:

Was it true when published?

Is it still true?

How much of public company performance is due to a few tech leaders?

How much does it matter to have a product or technical insight that incoming CEO doesn’t have?

Given all this, do you think it Is the best VC strategy to always back the founder (even if not always right are usually right and attract the best founders). Or when should you not back the founder?

How do founder/CEO incentives change if they know that their investors will never fire them or are public about backing the founder? Do they take more risk or otherwise misbehave?

As an aside, did you know there is even a small EFT BOSS for investing in public companies with a founder as CEO.

PS: to what extend is founder-led a proxy for (a) things are going well so founder no need to change (survivor bias) and (b) for public companies that they are younger and maybe smaller companies that have more growth in them?