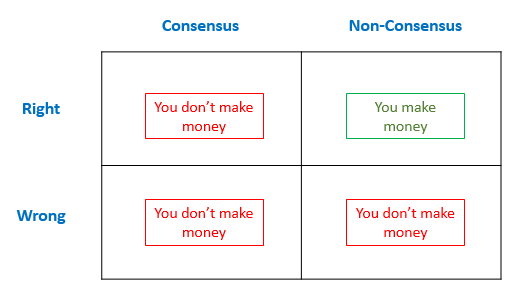

A simple yet powerful mental model.

You make money in venture capital by investing in companies that are not popular but are successful. There are a number of ways to be non-consensus including being first to know about a company, or investing in a company that others actively dislike or by investing in a region or sector that is overlooked.

If the company is a consensus company to invest in, the price will likely be higher to reflect that interest. With the higher price it will be hard to make a high return on the investment (although it is possible to make a large absolute amount of money).

If the company is not successful, you probably will not make money regardless of popularity.

Contrast with Momentum Trading.

Source: sometimes credited to Andy Rachleff of Benchmark