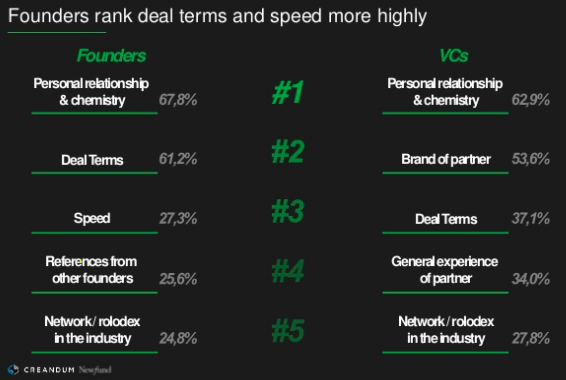

A 2018 study by Carl Fritjofsson (Creandum) and Henri Deshays (Newfund) surveyed 121 company founders and 98 VCs to identify similarities and differences between the two group’s preferences.

The data here is a couple of years old and individuals may not follow through on their stated preferences; however, this study provides an interesting portrait of VC founder-relations that can be useful to understanding modern developments in venture capitalism.

There is a gap in what VCs thought about their contribution relative to founders—VCs scored their level of “impact and helpfulness” 32 percent higher than entrepreneurs did.

Although there was overlap in a number-one preference for “chemistry” in VC-founder relations, this study is notable for showing that founders deviated from VCs most in their desire for speed in deal-making.

This makes sense. Procuring funding can be a stressful process for startups that are attempting to grow, despite precarious financial security. With limited time, quick access to funds is essential to ensuring that a company can quickly move forward to reach its goals. Spending weeks involved in negotiations that go nowhere can deplete limited resources for startups.

Speeding Up:

Given the understandable and palpable “need for speed” among founders, what can VCs do to speed up?

- Know Each Other: If a VC and a founder already know each other, or know the same people, it can increase the decisionmaking speed.

- Checklists: By establishing a clear list of benchmarks, it can be easier for founders to identify how to fulfill a VC’s requirements. On the other side, VCs can make investment decisions quicker and with clearer parameters.

- Clear Criteria: As a related point, establishing criteria that a VC will use to evaluate a company and a founder will use to evaluate a VC can help expedite the process. VCs could, for example, establish criteria on an application and ask companies to verify they meet it before reaching out.

- Discipline and Rhythm: As a VC, establishing external or internal goals can improve speed. This might include, for example, promises to respond in a specified number of days or have a certain number of meetings on a previously established basis. It can also taking the form of increasing the frequency of internal decision meetings.

- Outsourcing: Hiring external groups can free up resources and allow the process to move faster. This includes paying another party to help, for example, with data analysis, due diligence, background checks, or research.

- Format the Input: VCs can also create requirements for applications to adhere to a standard format and also that firms submit data as part of their application. This can help reduce the time it takes to process applications and compile a data set on a company.

- Decision Process: Changes to internal VC decision making can also help. This includes, for example, allowing partners to make their own independent deals, eliminating requirements for unanimous approval, or establishing a standard internal criteria benchmark (e.g. growth of five percent a week). Tribe is an example of a group that is utilizing quantitative approaches to create a benchmark.

- Know the Market: If VCs have a strong understanding of a certain market before evaluating a company, they can reduce the amount of time it takes to make a decision. By contrast, attempting to assess a startup’s merit while learning about a new industry may be time-consuming.

- Reference Checks Upfront: Given the emphasis VCs place on the quality of a startup’s team and its founders, reference checks are often an important evaluative tool. By calling informal references at the beginning of the process, VCs can speed up their decisions based on what they hear. This approach may be best suited for VCs checking on founders with more established careers and similar networks.

- What else?

Examples:

- Hustle Fund: This VC promises to provide an investment decision within one-two weeks of the first meeting.

- Tribe: By automating data analysis and using modern quantitative technology, Tribe can quickly provide the portrait of a company that is essential to making an investment decision.

- NFX’s The Brief: This is “Format the Input’ in action. NFX created a software that allows companies to draft their pitches in a standardized format that VCs are comfortable with.

- A16z: An example of a fund that I’ve seen do reference checks upfront.

By Miles Lasater with Julian Jacobs